The postings on this site are my own and do not necessarily represent the postings, strategies or opinions of my employer.

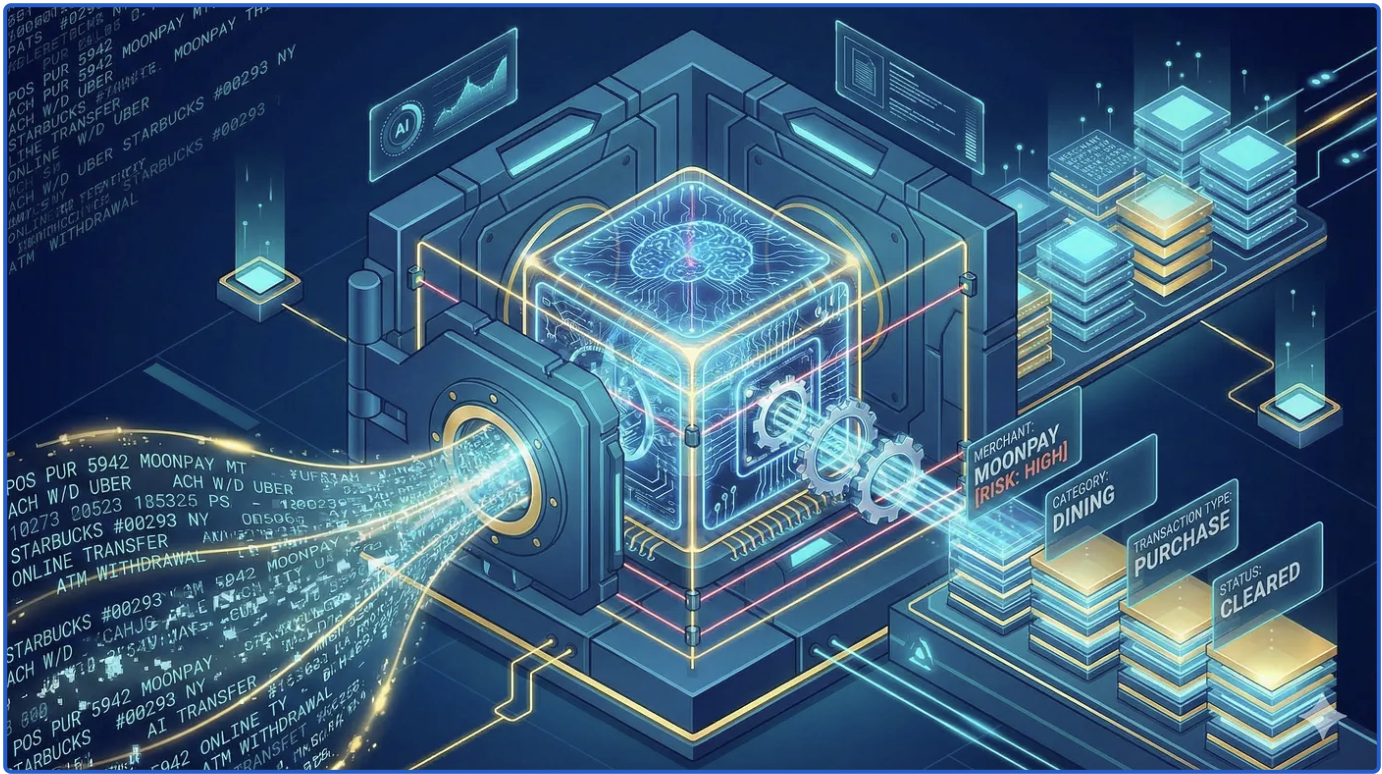

AI is revolutionizing the banking industry. By harnessing the power of data, banks can gain valuable insights into customer behavior, market trends, and operational efficiency. A robust data infrastructure is the foundation for building AI-powered applications that can personalize customer experiences, detect fraud, and automate processes.

- By analyzing customer data, banks can tailor their products and services to individual needs and preferences. AI-powered recommendation engines can suggest personalized financial products on key micro-moments (right context, right time, right offer). Moreover, chatbots and virtual assistants can provide 24/7 customer support, answering queries and resolving issues promptly.

- AI can help banks assess credit risk more accurately by analyzing a wide range of factors, including social media activity, online behavior, and alternative data sources. This enables banks to make informed lending decisions while minimizing risk.

- AI-powered automation tools can streamline various banking processes, such as account opening, loan processing, content writer, designers image creation and compliance checks. This frees up employees to focus on more strategic tasks, improving efficiency and productivity.

- By leveraging AI and data analytics, banks can develop innovative products and services that meet the evolving needs of their customers. For example, AI-powered robo-advisors can provide personalized investment advice, while blockchain technology can streamline cross-border payments.

Composable CDP

A Composable CDP provides a flexible and scalable framework for banks to effectively manage and utilize customer data. By integrating data from various sources, including websites, mobile apps, servers, SaaS tools, and advertising platforms, banks can gain a comprehensive understanding of their customers.

A well-architected CDP can also serve as a foundation for advanced AI applications, such as generative AI and machine learning. By leveraging AI, banks can enhance customer experiences, optimize operations, and identify new revenue opportunities. Ultimately, a robust CDP strategy can significantly contribute to a bank's profitability by driving customer acquisition, retention, and engagement.

Key benefits of a Composable CDP for banks:

- Unified Customer Profile: Create a single, accurate, and up-to-date view of each customer across all channels and touchpoints.

- Personalized Customer Experiences: Deliver tailored experiences based on individual preferences and behaviors.

- Improved Customer Acquisition and Retention: Identify high-value customer segments and implement targeted marketing campaigns.

- Enhanced Risk Management: Detect and mitigate fraud, and assess credit risk more effectively.

- Data-Driven Decision Making: Make informed decisions based on real-time insights and analytics.

Customer Data Management Strategy

Gartner's “Guidance Framework” promotes an agile approach to enterprise customer data alignment. This three-step iterative process is executed by a cross-functional team, allowing for flexibility and adaptation to changing requirements. Iterations can occur in parallel or sequentially, depending on the initiative's scope and dependencies.

The framework comprises three iterative steps for each customer data initiative:

- Assess and Plan: A cross-functional team is assembled to assess the initiative and determine its alignment with existing customer data services. This step involves identifying requirements, defining data models, and selecting appropriate technologies.

- Implement and Deploy: Customer data technology is deployed to support the initiative's requirements. The implementation aligns with shared customer data models, ensuring consistency and mapping capabilities. This step can involve various activities, such as data migration, data quality improvement, and master data management.

- Integrate and Connect: The optimal integration pattern and technology are selected for the initiative. Real-time data synchronization is prioritized for operational data, while batch or bulk transfer can be considered for analytical data. Additionally, process integration, including monitoring, alerting, and data protection, is incorporated.

The three categories of customer data management initiatives

Customer data is essential for delivering seamless cross-channel experiences, personalized offers, and insightful analytics. However, managing customer data across a complex enterprise application landscape can be challenging. Customer data management involves a blend of strategy, technology, and organizational alignment. As organizations strive to improve their customer data governance, architects play a crucial role in designing solutions that capture, protect, enable, and leverage customer data.

The first step is to categorize customer data initiatives.

Customer data management initiatives can be categorized into three distinct types:

- Operational Initiatives: These initiatives focus on the implementation of shared services that form the foundation of the enterprise application architecture. Examples include customer master data management, global customer ID assignment, consent management, and customer identity and access management. These services require real-time performance and operational reliability to ensure seamless integration and data consistency across various applications.

- Functional Initiatives: These initiatives are centered around endpoint applications that utilize customer data to deliver specific functionalities. Examples include CRM, ERP, and CDP systems. These applications act as both producers and consumers of customer data, and their requirements are constantly evolving to meet changing business needs. By integrating shared operational services, functional applications can improve data quality, consistency, and accessibility.

- Analytical Initiatives: These initiatives involve the aggregation and analysis of customer data to derive valuable insights. Examples include business intelligence, reporting dashboards, and data science-driven services. The output of these initiatives, such as customer segments or profile attributes, can be integrated into functional applications to enhance personalization and improve customer experiences.

From Clicks to Insights: Collecting the Right Data

By tracking customer interactions across multiple channels, banks can gain valuable insights into their behavior. For instance, analyzing website traffic and mobile app usage patterns can reveal customer preferences and pain points.

Real-time data collection and analysis enable banks to respond to customer needs promptly. By monitoring customer interactions in real-time, banks can identify issues and provide timely solutions. For example, if a customer is experiencing difficulty with a mobile app, a bank can proactively reach out to offer assistance.

A holistic data approach allows banks to segment customers based on various factors, such as demographics, behavior, and preferences. This enables targeted marketing campaigns and personalized product offerings. For example, a bank can offer tailored investment advice to high-net-worth individuals or provide specialized financial services to small businesses.

By understanding the customer journey, banks can identify opportunities to improve the overall customer experience. For instance, analyzing customer feedback and support tickets can help identify areas where improvements can be made. By streamlining processes and reducing wait times, banks can enhance customer satisfaction and loyalty.

A data-driven approach to customer engagement allows banks to build stronger relationships with their customers. By personalizing interactions and anticipating customer needs, banks can foster trust and loyalty. For example, banks can send personalized birthday greetings or offer tailored financial advice based on customer preferences.

Ensuring Data Quality: A Foundation for AI

A scalable data storage solution is essential for modern banks. Cloud-based data lakes provide a flexible and cost-effective way to store large volumes of structured and unstructured data. By leveraging cloud technologies, banks can easily scale their infrastructure to meet growing data demands.

Data quality is paramount for AI success. Before feeding data into AI models, it's crucial to clean, validate, and enrich it. By eliminating errors, inconsistencies, and missing data, banks can ensure the accuracy and reliability of their AI-powered insights.

Snowplow Trackers enable the capture of granular, unfiltered event data from a variety of sources, including web, mobile, and third-party systems. This raw data is then collected and stored in a scalable data lake (S3 or Google Cloud Storage).

The Enrichment process validates the incoming data against predefined schemas to ensure data quality and consistency. Additionally, the enrichment process adds valuable context to the data, such as user attributes, device information, and geographic location. Failed events are captured and stored for further investigation and potential reprocessing.

Validated and enriched data is made available for both real-time and batch processing. Real-time processing enables immediate insights and triggers, while batch processing facilitates in-depth analysis and reporting.

Snowplow's atomic data provides a comprehensive and immutable record of user interactions, enabling the development of sophisticated analytics and machine learning models.

Here's a breakdown of the customer data infrastructure, focusing on banking use cases:

Trackers (Data Capture)

- Web and Mobile Trackers: Capture user interactions on banking websites and mobile apps, including logins, transactions, and browsing behavior.

- Server-Side Trackers: Monitor backend systems for errors, performance issues, and security threats.

- Pixel Trackers: Track email opens, clicks, and conversions.

- Third-Party Web-hooks: Integrate with external systems (e.g., payment gateways, fraud prevention tools) to capture relevant events.

Collector (Data Ingestion)

- Real-time Stream Processing: Ingest data streams from various sources (trackers, APIs, databases) and process them in real-time.

- Data Validation and Enrichment: Cleanse and enrich data with additional context, such as customer demographics, account information, and transaction history.

Storage (Data Lake)

- Data Lake: Store raw and processed data in a scalable and cost-effective manner.

- Data Warehouse: Aggregate and transform data into a structured format for reporting and analysis.

Data Modeling (Data Transformation)

- Event-Level Data: Store detailed information about each user interaction, including timestamps, user IDs, and event types.

- Aggregated Data: Create summarized views of the data, such as daily active users, customer segments, and transaction volumes.

- Business Logic: Apply business rules to the data to calculate key metrics, such as customer lifetime value, churn rate, and fraud risk.

Analytics (Data Insights)

- Reporting: Generate reports on key performance indicators (KPIs), such as customer acquisition, retention, and engagement.

- Data Science: Utilize advanced analytics techniques to uncover insights, such as customer segmentation, product recommendations, and fraud detection.

- Machine Learning: Develop predictive models to forecast customer behavior, optimize marketing campaigns, and improve risk management.

CDPs can be a game-changer for banks, providing valuable insights into customer behavior and preferences. However, a poorly integrated CDP can become just another data silo, failing to deliver significant value.

The diagram illustrates how a CDP can optimize customer journeys in banking. By analyzing customer data, the CDP can identify key moments in the customer lifecycle, such as account opening, loan applications, and wealth management consultations. The CDP can then trigger personalized marketing campaigns, such as targeted email offers, SMS notifications, or personalized financial advice.

For example, if a customer has recently opened a checking account, the CDP can recommend additional products, such as a credit card or investment account. By tailoring interactions to individual customer needs, banks can improve customer satisfaction and loyalty.

Customer Data Platforms (CDPs) are powerful tools for consolidating customer data from various sources, including CRM, marketing automation, and web analytics. By unifying customer data into a single view, CDPs enable banks to gain deeper insights into customer behavior and preferences.

The reference architecture illustrates how a CDP can integrate customer data from different systems, such as core banking, CRM, and digital channels. This consolidated view of customer data enables banks to personalize customer experiences, improve marketing campaigns, and enhance risk management.